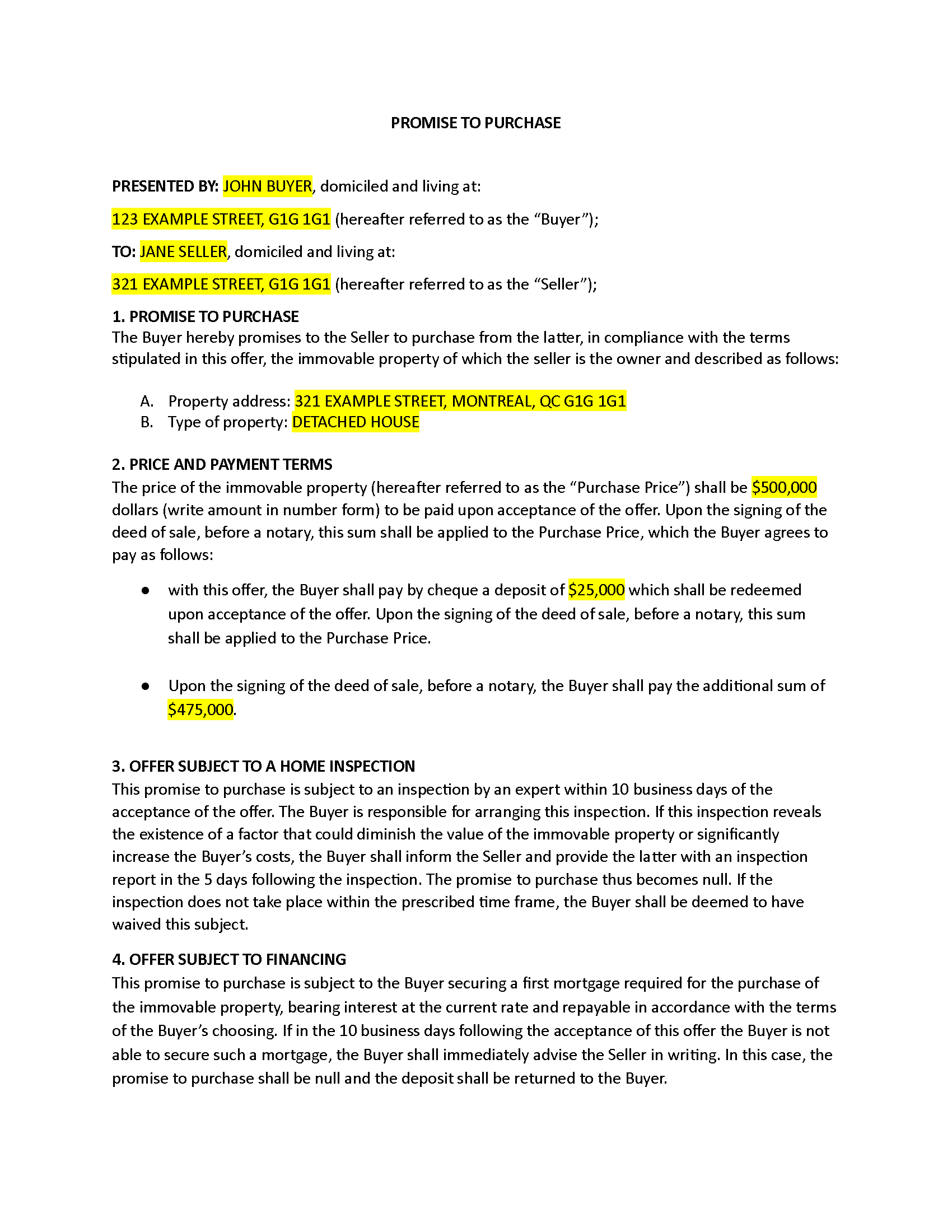

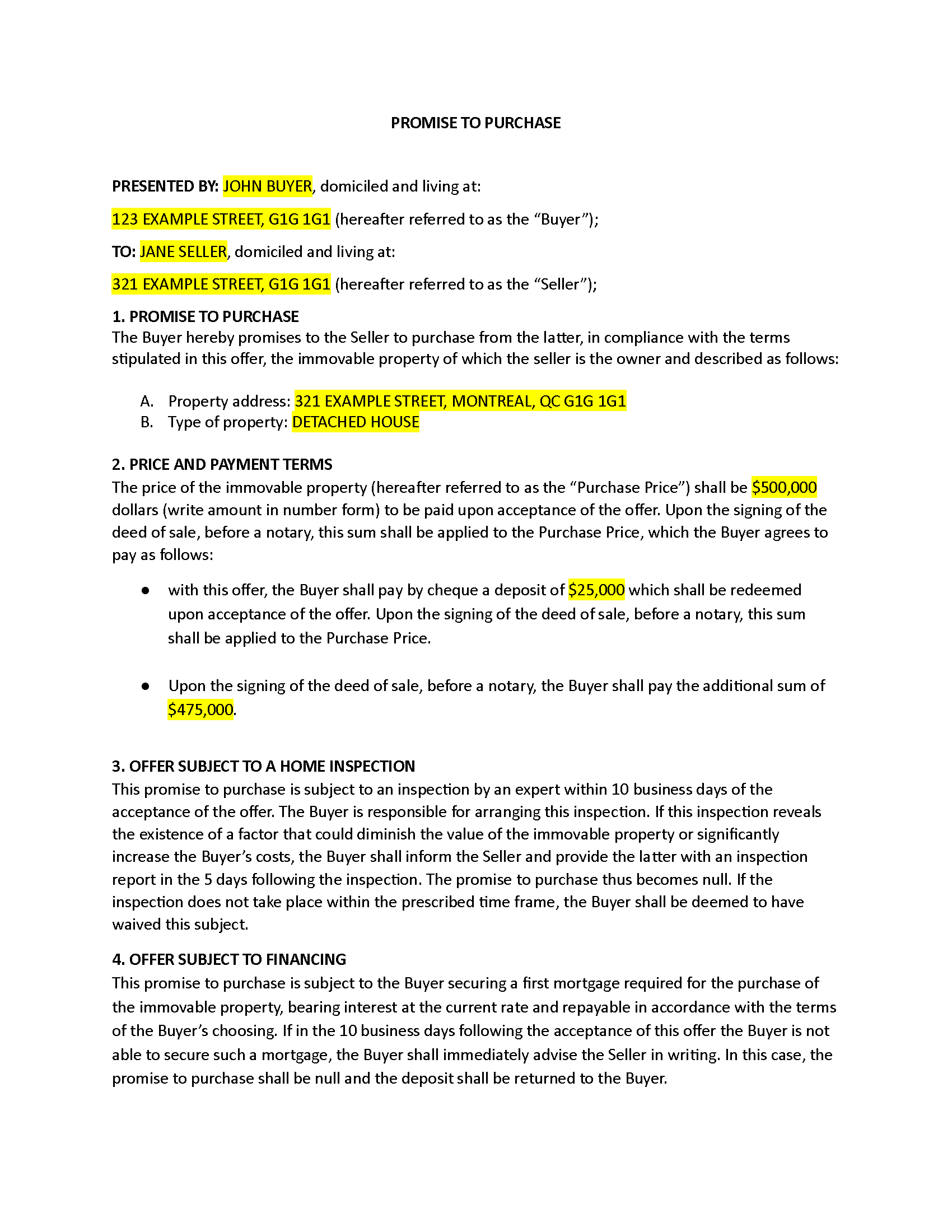

Downloadable promise to purchase template

Feel free to use our downloadable promise to purchase template.

Please note that the content of this document is for informational purposes only and has no legal value.

Download template

Updated August 15, 2024 | Published January 31, 2023

On this page, you’ll find a downloadable promise to purchase template. We’ll also explain what a promise to purchase is, what information to include in one, why it is important, and some key things to check before putting pen to paper.

If you are looking to buy or sell a home, a promise to purchase is a crucial part of the process—remember, this is one of the most important transactions you’ll ever make, and you’ll want to make sure everything is in order.

Read on to find out everything you need to know about the promise to purchase.

Feel free to use our downloadable promise to purchase template.

Please note that the content of this document is for informational purposes only and has no legal value.

ready for an online quote? Your time matters, and so does your stuff. Get a personalized home insurance quote in 5 minutes. That’s less time than it takes to wait in line for coffee.

Before you start, please review our Privacy Policy and Terms of Use.

A promise to purchase is a preliminary contract in which a potential buyer informs a seller of their intention to purchase the seller’s property under certain terms and conditions. It becomes a formal, binding commitment once it’s accepted by the seller. Though “promise to purchase” is the technically correct term, you may also hear this document called an offer to purchase or an intent to purchase.

The promise to purchase precedes the deed of sale. The seller must accept the promise to purchase before there can be any transfer of ownership. Since it is a legal document, the buyer or seller could be open to legal recourse if either party does not fulfil the contract.

A promise to purchase should include the following information:

Before you sign the promise to purchase, there are a few things you need to verify:

Once you sign the promise to purchase, the seller can either accept it, refuse it, or make a counteroffer. If the offer is accepted, you must fulfil the terms set out in the promise to purchase. If the offer is refused, you can always present a new promise to purchase.

The seller may also refuse your offer but respond with a counteroffer. This means that the seller would accept your offer if you met certain terms, such as an enhanced price or the exclusion of certain subjects. As the buyer, you may accept, refuse, or counter the seller’s counteroffer with your own.

A counteroffer cancels all previous offers.

Usually, it is not easy to back out of a promise to purchase. Remember, this is a contract the buyer and seller are compelled to fulfil. However, there are some exceptions:

A promise to purchase usually includes a deadline for the seller to accept or refuse the buyer’s offer. The buyer cannot withdraw their offer during this period, unless they inform the seller before they receive the offer. If the promise to purchase does not have a deadline, the buyer can withdraw the offer if the seller has not yet accepted it.

The buyer can also cancel a promise to purchase in the event a home inspection reveals any major problems with the property which would significantly increase the buyer’s costs.

The buyer and seller can also mutually agree to cancel the promise to purchase. However, the buyer or seller may have to compensate the involved real estate brokers for their commissions.

The buyer can also invoke the impossibility of securing financing. In this scenario, the buyer must prove that they cannot obtain the required financing despite their best efforts.

Finally, in Quebec, a buyer has ten days to cancel a promise to purchase for a new property or a property under construction. However, the builder or developer may claim up to 0.5% of the agreed selling price.

The seller can back out of a promise to purchase if the buyer does not accept it within the prescribed time frame. In this case, the promise lapses and the seller can argue that there never was an agreement, even if the buyer accepts it after the specified date.

The seller can also get out of the promise to purchase if it can be shown the buyer lied to or deceived the seller.

Finally, the seller can withdraw from the promise to purchase if the buyer does not meet any terms of the agreement, such as financing.

Remember, these terms and conditions can only be invoked if they were part of the promise to purchase in the first place.

If the buyer or seller refuses to sign the deed of sale after accepting the promise to purchase, it is possible to force the sale through what is called the action in passing of the title. Either party may initiate this legal action.

There are a number of documents and criteria required to initiate an action in passing of the title:

However, an action in passing of the title becomes moot if the house is sold to a third party in the meantime. For example, a seller may be tempted by a better offer from a third party. According to the law, a deed of sale in violation of a valid promise to purchase cannot be annulled by the aggrieved buyer. But, the buyer in question is eligible to receive compensatory damages from the seller and even the third-party buyer, if it can be proven that the latter did not purchase the property in good faith (if they colluded with the seller, for example).

In the event the seller intends to sell the home to a third party in violation of the promise to purchase, but has not yet done so, the buyer can obtain a provisional injunction ordering the seller to not sell the property to another buyer.

Yes. However, in case of a dispute, the aggrieved party must be able to prove the existence of the promise to purchase, which could be problematic if the promise was made verbally. It is recommended to make a promise to purchase in writing and to keep a copy of the document.

A promise to purchase is a legal document that contains a lot of important information. It is recommended that you use the services of a realtor/real estate broker, a lawyer, or a notary. These professionals will be able to spot any irregularities with the document and point out anything that’s missing.

No. The promise or offer to purchase is a preliminary contract that is signed before the deed of sale. The promise to purchase binds the buyer and the seller to the terms of the sale. The deed of sale is the conclusion of the transaction before a notary or lawyer. This is when the ownership of the property is formally transferred.

Looking for more helpful templates? Visit our Template resource centre to find ready-to-use templates for a range of important documents. Or, get an online quote in under 5 minutes and find out how affordable personalized home insurance can be.

Check out these related articles:

Get a personalized online home insurance quote in just 5 minutes and see how much money you can save by switching to Square One.

Even when you take precautions, accidents can happen. Home insurance is one way to protect your family against financial losses from accidents. And, home insurance can start from as little as $15/month.