The important points

- A VIN is a car’s lifelong ID. It’s a one-of-a-kind code that the manufacturer assigns to each vehicle they produce encoding details like the car’s origin, manufacturer, features, and history.

- Always check that the VIN on the car matches the title and registration documents to avoid scams involving stolen vehicles or fabricated VINs.

- Insurance companies use the VIN to extract a car’s details, assess its risk, and calculate the appropriate premium. They’ll use this to determine the fair settlement amount when you make a claim.

What is a Vehicle Identification Number?

In the automotive world, the Vehicle Identification Number (VIN) functions as a car’s unique fingerprint. Just as a passport serves to identify a person, the VIN serves to identify your car. It’s a 17-character alphanumeric code car manufacturers assign to each and every vehicle they produce.

Every time a new car enters the assembly line, it gets a unique VIN assigned to it. That means that no two cars can ever share the same identity. Manufacturers will usually assign the VIN once they’ve gathered all the parts for the car and are ready to begin production.

However, the VIN is more than just some random combination of letters and numbers. Each of the 17 characters relates to something specific about the car. It’ll indicate who made it, where and when it was made, and any special features it comes with. We’ll explain what each part means later on in this article.

Beyond that, authorized parties can also use the VIN to obtain a car’s previous records and vehicle history report. These can be used to know how many times a car has changed owners, if it’s been damaged in the past, and whether any claims were made under its title.

Where is the VIN located?

Typically, car manufacturers stamp the VIN on the vehicle itself. There might be variations between older and newer models on where the VIN is located exactly. But often, you’ll find it located around these areas:

- Above the driver’s dashboard looking in from the front windshield

- On the driver’s side door by the door jamb

- Under the hood on the engine block itself

- On the car’s ownership papers and service records

If you’re considering buying a pre-owned vehicle, you can verify that the car is legitimate by looking up the VIN online. This simple step could be what saves you from buying a car that’s been identified as stolen, misrepresented with a forged title, or unsafe.

It’s important to note: regardless of how many times a car has been owned, sold, damaged, or repaired, the VIN stays the same for the car’s entire lifetime.

The importance of a VIN in insurance

To apply for car insurance, you’ll need to know the VIN of your vehicle. Without a valid VIN, it’s practically impossible to obtain coverage.

Insurance companies rely heavily on this number to identify your car and assess the risk of insuring it. They’ll reference the VIN on databases (typically from the manufacturer) to extract details about the car’s make, model, year, engine size, and so on. They can compare these specifics to historical data to gauge the relative theft risk, repair costs, and other information. This helps them determine the appropriate premium for your particular car.

The VIN also acts as a line of defense against insurance fraud. Consider the following example:

Example

Liza buys a second-hand car not knowing it has been re-vinned — a crime where a car is sold with a stolen or fabricated VIN. Not verifying the details beforehand, she discovers she’s been deceived when she attempts to register or insure her car and an agent lets her know the VIN plate doesn’t match the number on the vehicle ownership permit. Or in another case, she gets pulled over by a police officer who lets her know the car’s been tagged as stolen.

Fortunately, Liza can’t be faulted for driving a car she didn’t know was falsely advertised. The police or relevant authorities won’t necessarily punish her, but it’s likely she’ll face the unfortunate reality of losing the car and the money she paid for it. However, there is a possibility of recovering those funds if the authorities locate and apprehend the original seller. In that case, Liza could file a lawsuit to reclaim her losses.

This is why it’s crucial to always verify a car’s details, particularly before you make a transaction. Make sure that:

- The VIN on the car matches the VIN on the title and registration documents.

- You can locate all the VIN plates on the car itself.

- You’ve conducted a VIN history check through a service like CARFAX, to identify any discrepancies.

The VIN also plays a role after an accident. When you file a claim for a loss that’s covered by your policy, the insurer uses the VIN to identify your car and estimate the cost of repairs. They’ll use the VIN to look up your vehicle’s details, like its year, make, model, and trim, and approximate the standard repair costs for parts and labor — essentially your settlement — to get your car back on the road. Or, if the estimated repair cost is higher than the vehicle’s cash value, they would declare it a total loss instead.

Once you take it to the repair shop, they’ll use the VIN to assemble the parts compatible with your specific model. This ensures they’re not installing it with mismatched components that could eventually cause safety hazards down the road.

How to decode a VIN?

We’ve discussed why a VIN is important in car insurance. But what does it actually tell you?

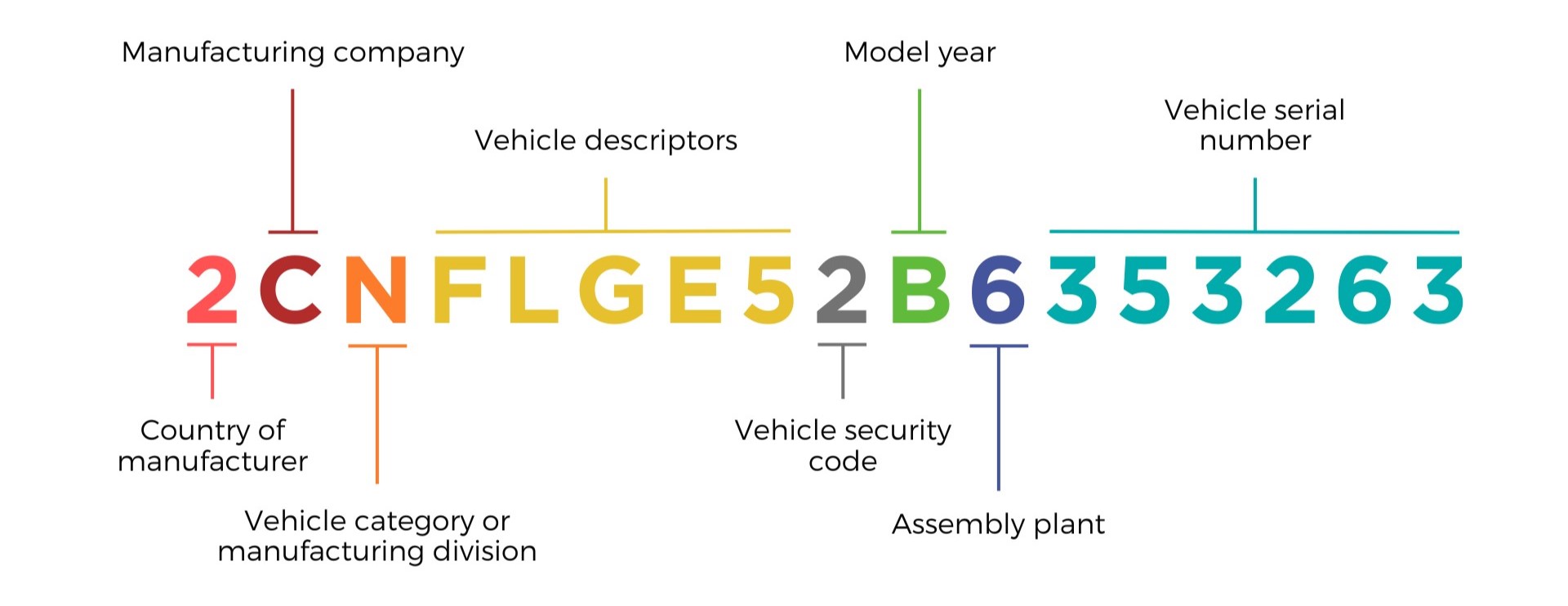

Take the following VIN as an example:

The first character is the country of the manufacturer. The 2 in this example points to Canada. 1, 4, or 5 would indicate the car was built in the United States.

The second and third characters work together to indicate the vehicle’s manufacturer. In this example, the C correlates to Chevrolet. As for the third character, some use it as a code for a vehicle category or to indicate the specific division within the manufacturer. Its meaning varies greatly depending on who built the car.

Characters four through eight are the vehicle’s descriptors. They indicate the body type (sedan, minivan, SUV, etc.), engine type and size, vehicle model, and the presence of a restraint system (like airbags or seatbelts).

The ninth character is the vehicle’s security code which helps verify the legitimacy of the VIN. Don’t worry about deciphering this yourself. Insurance companies use it to verify that the VIN has been authorized by the manufacturer.

The tenth character is the model year of the vehicle, indicated by a letter or number. For vehicles made between 1980 and 2000, the tenth character starts with A in 1980 and ends with Y in 2000.

For model years before 2001 and 2009, the tenth character was simply a number corresponding to the last digit of the year (e.g., a 5 for 2005). Since 2010, a letter code has been used to represent the model year. This code started with A in 2010 and will continue until letter Y in 2030. Interestingly, VINs don’t include the letters I, O, Q, U, or Z.

Character 11 reveals the assembly plant where the vehicle was built.

Characters 12 to 17 of the VIN form the vehicle’s production or serial number. Each manufacturer uses a unique sequence, which means each car will have a unique serial number.

What if the VIN is less than 17 characters long?

Most likely, this means the car was manufactured before 1981. Before then, there wasn’t a standardized VIN format. Vehicles were issued VINs shorter in length, typically containing 8-10 characters (sometimes even less). They also varied in coding structure from one manufacturer to another.

Now, if you wish to insure one of these vehicles, you’ll have to check whether it meets the insurer’s eligibility criteria first. Most insurance providers set a vehicle age limit of 20 years old, but a few will extend that to 30 years.

There are many exceptions, and sometimes cars can be accepted for insurance if they have a collectible or limited-edition status. Again, this will depend on the eligibility criteria set by the insurance company.

Looking for another insurance definition? Look it up in The Insurance Glossary, home to dozens of easy-to-follow definitions for the most common insurance terms. Or, get an online quote in under 5 minutes and find out how affordable personalized home insurance can be.

About the expert: Daniel Mirkovic

A co-founder of Square One with 25 years of experience in the insurance industry, Daniel was previously vice president of the insurance and travel divisions at the British Columbia Automobile Association. Daniel has a bachelor of commerce and a Master of Business Administration (MBA) from the Sauder School of Business at the University of British Columbia. He holds a Canadian Accredited Insurance Broker (CAIB) designation and a general insurance license level 3 in BC, Alberta, Saskatchewan, Manitoba and Ontario.