Daniel co-founded Square One, an online home insurance provider, in 2011. The company offers the only home insurance policy that Canadians can personalize to their individual needs. He is also a board director for Goose Insurance Services, a mobile-first travel insurance provider in Canada, and the KBI Group, a commercial insurance brokerage in Australia.

Before starting Square One, Daniel was vice president of the insurance and travel divisions at the British Columbia Automobile Association (BCAA). Under his leadership, BCAA was recognized for having:

Daniel previously worked for the Farmers Insurance Group as a product manager for the company’s home insurance product in Montana, Nebraska, North Dakota, South Dakota, and Wyoming. And, he started his insurance career working for the General Accident Assurance Company as a business analyst and personal lines underwriter.

Daniel has a bachelor of commerce and a master of business administration, both from the Sauder School of Business at the University of British Columbia. He majored in Finance for both programs.

He holds a Canadian Accredited Insurance Broker designation and a general insurance license level 3 in BC, Alberta, Saskatchewan, Manitoba, and Ontario. Daniel is the nominee for Square One’s corporate agency license.

Daniel is respected for his expertise in the personal insurance industry, including the following lines:

In terms of business disciplines, Daniel’s expertise lies in the following areas:

Daniel has been featured on several different news and insurance sites, providing useful information and help educate the public on insurance.

Read the articles that Daniel has been quoted in or has reviewed for accuracy of information following our editorial guidelines.

Every insurance provider has their own way of calculating premiums, but they generally follow the same principles. Here, we’re going to describe some of the factors that Square One uses to calculate premiums for policies we sell.

Imagine that you’re going on vacation. What about all the stuff you’re taking with you – luggage, camera, golf clubs? If something happens to your personal property while you’re travelling, will your home insurance cover it?

Learn why you absolutely need landlord’s and rental income insurance if you’re renting out a home in Canada, and how it can save you long term financial headaches.

Perhaps you’re operating a small business out of your home, or maybe you’ve decided to start one in the future – congratulations! You probably have a long “to do” list, but one critical item should be contacting your insurance provider.

“This policy contains a clause which may limit the amount payable.” You’ve probably seen this sentence on the front page of most home insurance policies, but have you wondered what it actually means?

Your home is probably your single greatest asset. If a catastrophe occurs, such as a fire or a major earthquake, is this asset properly protected? When was the last time you reviewed your home insurance policy?

This guide helps homeowners not only understand all the aspects around home insurance, we also give you tips so you can save money on your insurance policy too. Learn about different coverage types, terms to know, what’s covered and more. Get all your questions answered in one guide.

Do you really need tenants insurance in Canada? Find out the top reasons why you should have tenant insurance, regardless if your landlord requires it or not.

Learn the difference between tenant insurance and landlord insurance. As a tenant, you can’t rely on your landlord’s insurance. Find out why.

Learn why you need tenants insurance when living with a roommate. Also, learn the pros and cons of sharing a policy with your roommate.

While it’s not required by law, there are several reasons why you as a landlord can better protect yourself by having your tenants purchase their own renters insurance policy. And, learn how renters insurance can benefit your tenants as well.

Learn when a landlord can enter their rental unit and what kind of notice must be given to a tenant. Also, learn what your home insurance provider will want to know about your rental unit.

Learn about earthquake insurance in Canada. We explain how earthquake home insurance coverage works and where you can find it.

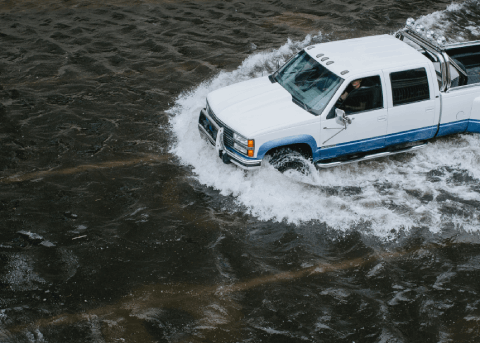

Learn about flood insurance coverage options in Canada. We also explain when flood damage is typically covered and when it is excluded.

Learn how you can insure new possessions and items you buy or get as gifts. You’ll also learn the importance of completing a home inventory and how to do it properly.

Your home insurance provides coverage for your personal property. But did you know that there are limits on certain types of property? Items like sporting goods, business property, cameras, and others can have special limits that you need to know about.

Learn the important information you need to know about COVID-19 and your home insurance as a homeowner, landlord, tenant and other information on claims.

Learn how changing deductibles, updating your home and other tips can lower your home insurance premiums with these 9 tips from Square One.

Learn about the different types of home insurance, how the coverages are different and what is the best type for you.