Who’s responsible for condo repairs?

With regular maintenance, it’s relatively straightforward to tell who does what. When it comes to repairing damage, though, it gets a little bit more complex.

Before we get to the complicated parts, let’s start with the basics:

| Condo corporation responsibilities |

Owner responsibilities |

- All common property

- Individual units as they were originally constructed

|

- Improvements made to their unit over and above the original construction

- Their own personal property (furniture, clothing, electronics, etc.)

|

Another way to think of this is to picture a brand-new condo building. Construction is finished, but no one has moved in yet. This is what the condo corporation is typically responsible for repairing.

Now, the owners move in. Anything they add or change within their units is their responsibility—their furniture and other possessions, new floorboards, custom granite countertops… these things are the sole responsibility of the owner.

Pretty straightforward, right? Now let’s talk about the things that add complexity to the situation: bylaws, insurance, and liability.

How condo bylaws affect repairs

As we established earlier, every condo building has its own set of bylaws. Plus, each province has its own condo legislation. Bylaws and provincial laws have a lot to do with assigning responsibility for condo repairs.

So, while condo corporations are typically responsible for repairing units as-constructed, they may have bylaws that stipulate owners must pay for all repairs inside their unit. They also may define “inside the unit” differently; sometimes pipes and wires that service the unit are the owner’s responsibility, other times they are the corporation’s.

This is going to come up a lot, but it bears repeating: check your own condo building’s bylaws to be certain of your own situation. If you aren’t sure where to look or how to interpret them, ask your property management company for assistance.

Now, depending on the nature of the damage, neither the condo corporation nor the owners will have to pay everything themselves—insurance often helps out as well.

Condo repairs and insurance

There are two types of insurance that matter when we’re talking about condo repairs: condo master policies and condo owner policies. You can learn more about these policies in the aforementioned condo basics article, but here’s the short version:

Each condo corporation has one master policy. The master policy covers everything for which the corporation is responsible—the building as-constructed, basically. The master policy also includes liability coverage for the corporation, in case (for example) a visitor slips and falls in the lobby.

Each owner within the building has their own owner policy. Condo owner policies cover those things for which the owner is responsible: the improvements to their unit, their personal property, and their personal liability. Some condo owner policies also offer coverage for loss assessments (we’ll touch on those in a moment).

Master policies sound pretty thorough; after all, they cover essentially the entire condo building. This leaves some condo owners to believe they don’t need an owner policy, since the corporation’s insurance will cover their unit as-built.

But, most master policies have very high deductibles. A deductible is the amount of money that the policyholder has to pay before the insurance company pays the remainder of a claim. Many master policies have deductibles of $100,000 or more.

If the condo corporation has to make a claim against its master policy, someone has to pay that deductible. While corporations do keep reserve funds, they may not have enough. Or the condo corporation may not wish to use the reserve funds to pay the deductible.

It’s also important to note that not all repairs fall under insurance coverage. Damage from regular wear and tear, for example, isn’t covered by any insurance policy—the corporation and owners would have to foot the entire bill.

That brings us to an important point: who actually pays for repairs?

How liability affects repairs

Sometimes damage is no one’s fault, like damage arising from an earthquake or a windstorm.

In a no-liability situation, like an earthquake, the responsibility for repairs is straightforward: the corporation is responsible for bringing the building (including units) to the state they were in at the time of construction. The owners are responsible for any improvements they made to their unit, plus their personal property.

Assuming the damage is covered by the master policy, the process would look something like this:

- The condo corporation makes a claim against their master policy. The corporation works with the insurer to repair or rebuild the condo property as it was constructed.

- The corporation pays the deductible out of its operating or reserve funds. If there isn’t enough money available from either source, the corporation make up the difference by issuing loss assessments to the owners.

- The insurance company pays for repairs above the deductible.

A loss assessment is when the condo corporation needs more money from its owners in order to repair unexpected damage. In cases of significant damage (like from a natural disaster), the loss assessment would be shared proportionally amongst all the building’s owners. If there are 100 equal units in the building, each owner would pay 1/100th of the assessment.

If the damage was not covered by the master policy, the process is similar. However, instead of issuing a loss assessment to pay for the deductible, the loss assessment would have to pay for all of the repairs.

A note on special assessments

As mentioned, regular maintenance and replacement isn’t covered by insurance. As a building gets old, some things naturally need to be replaced; these costs fall to the building’s residents. Hopefully, the corporation has planned for such projects and set aside an adequate reserve fund. If they haven’t, they would have to make up the difference with an assessment.

Assessments for situations that aren’t covered by insurance are called special assessments. Special assessments can arise for a number of reasons, like topping-up a low reserve fund or investing in major changes to a building’s appearance.

We’ve now seen how it works when damage is no one’s fault. But, things change if a person, either intentionally or accidentally, caused the damage. In most condo buildings, the responsible party would have to pay some or all of the repair costs—again, it depends on the bylaws.

This situation can arise if, for example, an owner absentmindedly leaves their bathtub running until it overflows and damages the units below.

In such cases, the condo corporation could still issue a loss assessment, but they would issue it only to the liable owner. The corporation would still normally manage the repairs, but the at-fault owner would have to cover the bills.

One last thing:

If a unit is damaged, and the repair costs are below the master policy deductible, the condo corporation may tell the unit’s owner that they’re on their own. Normally, the corporation is responsible for repairing that unit to its as-built state. However, bylaws may permit them to push full responsibility to the unit owner if the master policy deductible isn’t met.

In such cases, the owner’s condo insurance provider may or may not cover the repair costs. This is yet another reason that it’s important to understand your home building’s bylaws and your condo insurance policy.

Condo owners insurance

We’ve talked a lot about condo master policies, but condo owner policies are just as important.

Condo insurance includes several different coverages, many of them optional (but all of them recommended). At the most basic level, a condo owner policy covers the owner’s personal property, and their personal and premises liability.

Condo insurance can also cover improvements made to the unit, sometimes called improvements & betterments. If the building has to be rebuilt or significantly repaired, this coverage would help with the cost of bringing the unit back to its improved state, rather than the as-built state covered by the master policy.

A condo owner can also buy loss assessment coverage. This kicks in when the condo corporation assesses repair or deductible costs to the owners. With loss assessment coverage, the owner need only pay their own policy deductible (likely much smaller than the master policy’s deductible), while their insurer covers the remainder.

Square One offers Condo Owners Protection, which rolls the important optional condo coverages into one simple package.

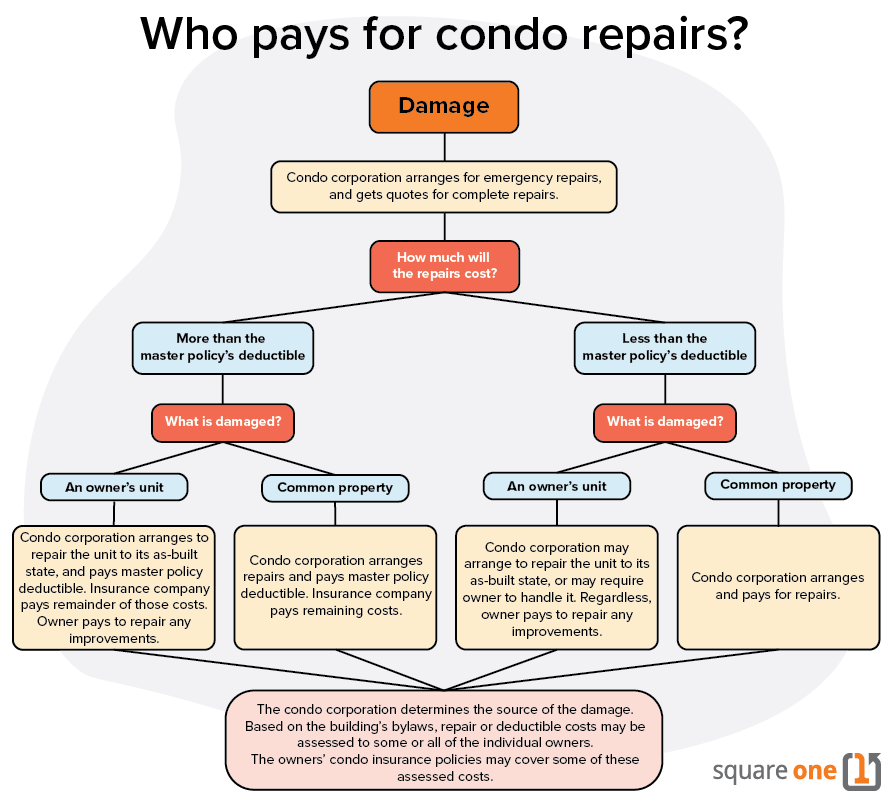

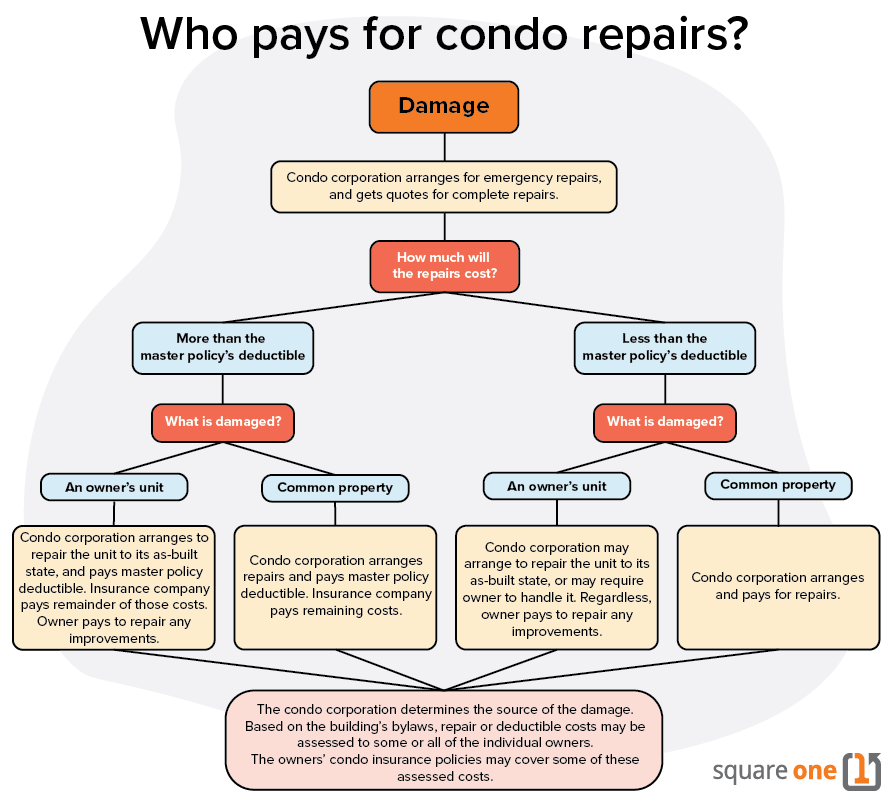

Condo repair flowchart

After all that, condo repair responsibilities probably seem pretty complicated. When you’re dealing with a condo corporation, multiple owners, and multiple insurance companies, things are bound to get confusing.

One last time: always check your building’s bylaws to be certain of how things work for you.

That having been said, here’s a flowchart that shows the typical process for assigning responsibility for condo repairs:

Want to learn more? Visit our Condo Owner resource centre for more helpful articles about the intricacies of condo life. Or, get an online quote in under 5 minutes and find out how affordable personalized home insurance can be.

About the expert: Daniel Mirkovic

A co-founder of Square One with 25 years of experience in the insurance industry, Daniel was previously vice president of the insurance and travel divisions at the British Columbia Automobile Association. Daniel has a bachelor of commerce and a Master of Business Administration (MBA) from the Sauder School of Business at the University of British Columbia. He holds a Canadian Accredited Insurance Broker (CAIB) designation and a general insurance license level 3 in BC, Alberta, Saskatchewan, Manitoba and Ontario.