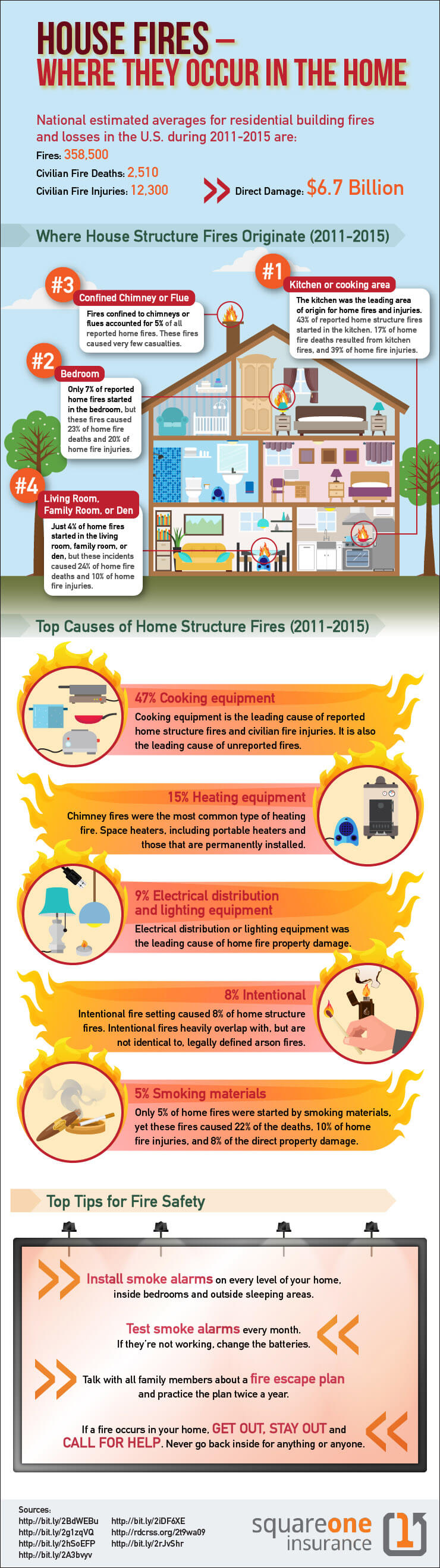

One unpleasant threat to homeowners, one that no one likes to ponder, is fire. Yes, there is homeowner’s insurance to address the property damage caused by fire, but the policy cannot magically cure injuries, reverse accidental deaths or conjure lost property from cinders. Therefore, the best remedy is prevention and planning. If you do your best to prevent fire and prepare in the event that one occurs, there is a better chance that you’ll cope well if a fire does break out in your home.

Setting up a home smoke detector

The first step in preventing injury from fire is to install smoke alarms throughout your home; newscasts regularly report fires that spread because the residences had no smoke alarms. The smell of smoke alone won’t necessarily wake you up; in fact, the fumes could cause you to sleep more deeply.

Mount the smoke alarms outside each room and check them twice a year. Make it part of your routine to check the batteries each spring and fall when you change the clocks – it’s easy to remember. Change the batteries annually.

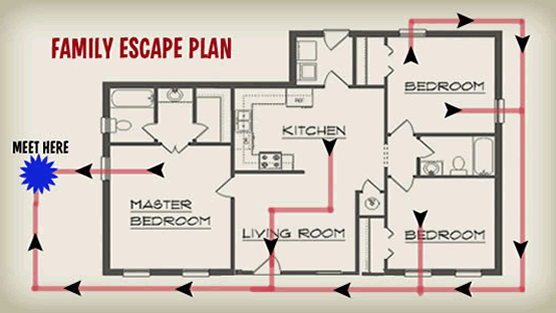

Make a home fire evacuation map

Next, it’s time to create an escape plan from each room in the house; you should have two options per room, in case one exit is blocked by fire. Map the layout of the house, mark the escape routes and post this on your refrigerator where everyone can see it and be certain that everyone knows the escape plans. If a fire escape ladder is needed, make sure to test it before if you can so you know how to use it in an emergency.

Designate a safe place for your family to rendezvous outside the house in the event of an escape from fire. Then, hold a family fire drill at least twice a year: press the smoke alarm button or yell “fire” and ensure that everyone leaves the house and meets at your designated rendezvous spot. Pretend that the fire has started in a different room each time so no one becomes complacent.

Communicate a family emergency plan

Create an emergency communication plan for your family so that if you can’t meet at your designated rendezvous spot or you get separated, everyone knows whom to call to advise them of their safety and whereabouts. Make sure to inform the designated contact of their potential involvement, and ensure that everyone in the family knows their phone number(s) and address by heart.

Best practices in evacuating during a home fire

In the event that you do have a house fire, make sure your family members know what to do to get out of the building safely:

- Avoid panic. Staying calm during a crisis enhances your chance of coping well;

- Don’t try to rescue pets or valuables; the delay could mean the difference between life and death;

- Don’t investigate the fire;

- Smoke inhalation can cause death, so try to inhale as little as possible; stay low to the ground and, if you can, place a wet cloth over your nose and mouth to make breathing easier;

- Feel doors with the back of your hands – they’re less delicate than the palms – and if they feel hot, don’t open them. It’s an indication the fire is on the other side, so find another route;

- If your clothes catch fire, use the time-tested technique of Stop, Drop and Roll.