How to choose variable-rate vs. fixed-rate mortgages

Choosing between variable-rate and fixed-rate mortgages largely comes down to how much you value predictability and stability.

“With a fixed-rate mortgage, you will have no surprises for the term’s length, and you will know how much interest rate you will be paying throughout the term,” says Thake. “However, you may want to consider a variable mortgage rate if you have a flexible budget and feel comfortable with the fluctuating interest rates. It is also possible to finish paying off your mortgage much faster.”

In the big picture, variable rate mortgages generally end up with lower interest rates on average. Studies have shown that, historically, variable-rate mortgages are cheaper than fixed 70-80% of the time.

If you’re not comfortable with that 20-30% chance of higher interest rates, a fixed-rate mortgage might be your best bet. And of course, taking a more focused view of recent history, variable rate mortgages saw nigh-unprecedented rate hikes in 2022.

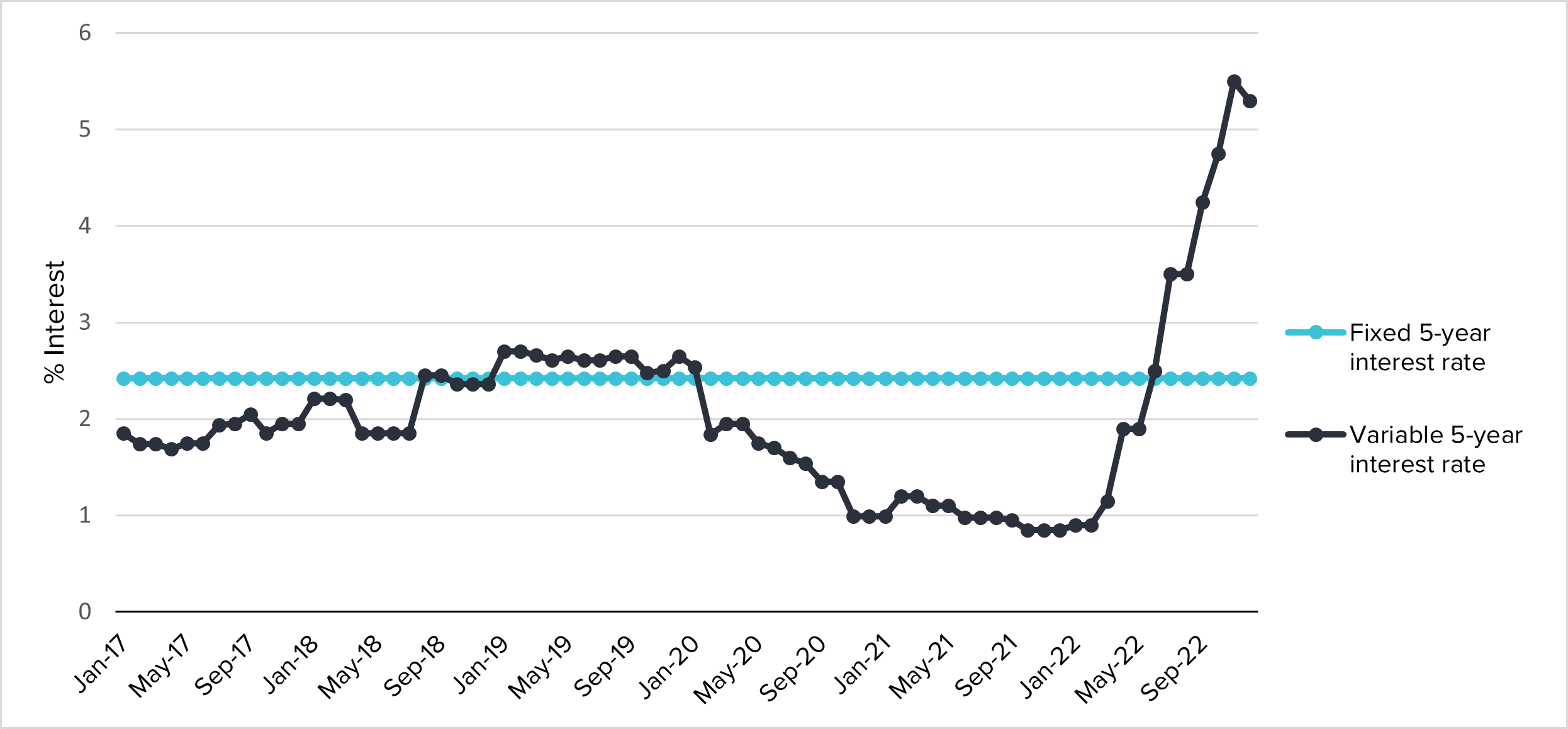

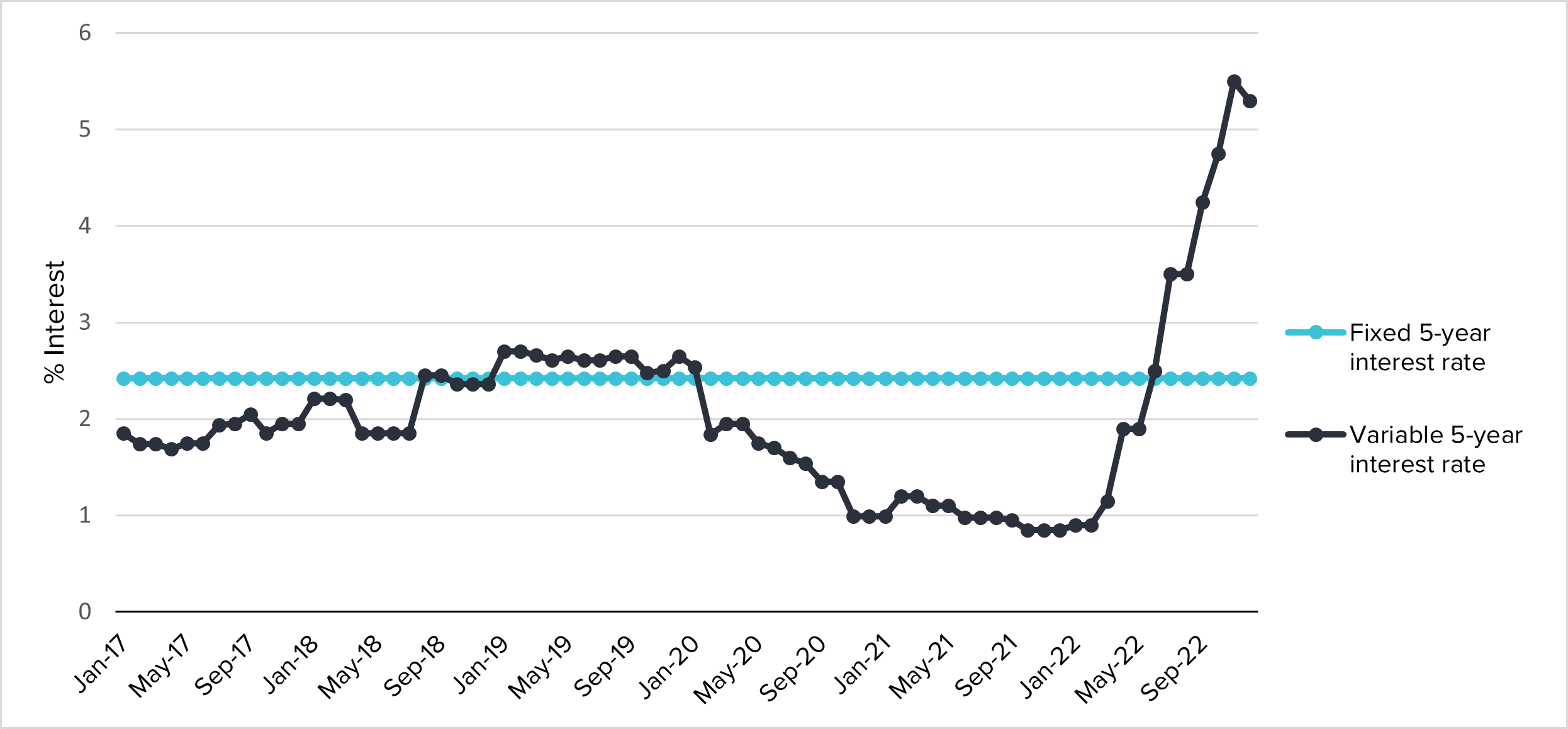

As an example, we can look back on historical interest rates:

If you had secured a mortgage in January 2017, you could have locked in a 5-year fixed rate at around 2.4% or chosen a 5-year variable rate starting at around 1.9%.

Based on average interest rate data from ratehub.ca, here’s what your mortgage’s interest rates might have looked like between 2017 and 2022 based on those options (assuming your interest was calculated monthly):

Of course, these are estimates, but you can see how the fixed-rate interest is totally predictable, while the variable-rate interest jumps up and down. In this timeframe, the variable rate option was much cheaper—until suddenly it wasn’t. The financial environment of 2022 wasn’t typical, but it still highlights the relative unpredictability of variable rate mortgages.

Given that interest rates are in a constant state of flux, you also need to consider what the present market is like when you’re searching for a mortgage.

“When interest rates are low and are unlikely to fall further, many borrowers prefer to lock into a fixed-rate,” says Charach.

But there are other advantages of fixed-rate mortgages, too:

“Another benefit of a fixed-rate mortgage is that qualification may be more straightforward,” says Charach. “The lender does not have to factor in potential rate increases. It is important to note that pre-payment penalties may be higher if you break a fixed-term mortgage early. Lenders usually calculate a 3-month interest penalty or interest rate differential, whichever is greater.”

The terms of many mortgages in Canada stipulate that you’re not allowed to pay off the mortgage faster than the agreed-upon rate. In these cases, you’ll need to pay a penalty if you decide to pay off your mortgage early. As Charach says, those penalties tend to be higher on fixed-term mortgages.

When it comes down to it, here are Charach’s suggestions for choosing fixed vs. variable mortgages:

Fixed-rate mortgages are most suitable for borrowers who:

- Are not planning to pay the mortgage off early

- Are rate-sensitive

- Are first-time buyers

- Are on a tight budget

- Have a growing family

Variable-rate mortgages are most suitable for borrowers who:

- Have a high net worth

- Have a moderate risk tolerance

- Have more than the minimum income they need to qualify for the mortgage

- Have a stable income

- Are planning on paying off the mortgage in the short term

Speaking of paying off the mortgage early, that’s where we get into the next category: open vs. closed mortgages.

What is an open mortgage?

As we’ve alluded to, many mortgages do not allow the borrower to pay off their debt earlier than planned. Or at least they impose penalties for doing so.

Open mortgages do not have such restrictions.

If you have an open mortgage, you may pay off your mortgage early, either by increasing your regular payments or with extra lump-sum payments.

“Although this type of mortgage is generally more expensive than a ‘closed’ mortgage,” says Charach, “the borrower may prepay in part or full without notice or penalty—ideally suited for short-term mortgage needs.”

Open mortgages are all about flexibility.

What is a closed mortgage?

Unlike open mortgages, closed mortgages don’t offer much flexibility at all when it comes to repayment.

When you sign on for a closed mortgage, part of what you’re agreeing to is the payment schedule. You’ll be paying a set amount of money over a predetermined period of time.

On a fixed-rate closed mortgage, you’d pay the same amount of money every month until the term expires. On a variable-rate closed mortgage, your monthly payments would go up or down with your interest rate, but they’ll still be set by your lender.

If you wish to repay your mortgage faster, your lender will charge you a penalty for doing so. That penalty varies depending on the type of mortgage you have:

“One of the benefits [of a variable-rate product] is that the pre-payment penalties are often lower than a fixed-rate mortgage, as many lenders only charge a 3-month interest penalty if you break your variable-rate mortgage early,” says Charach.

In Canada, most mortgages are closed mortgages. Though they lack the flexibility of open mortgages, they benefit from lower interest rates.

How to choose between open vs. closed mortgages

Sometimes, you don’t have much of a choice between open or closed mortgages. If you’re looking for the best rate, you’ll pretty much have to take a closed mortgage.

“A closed mortgage has a much lower interest rate compared to open mortgages,” says Thake.

As mentioned, the majority of borrowers opt for closed mortgages. The money savings make the extra restrictions worthwhile.

There are a few scenarios in which a borrower might want extra flexibility, though:

“Consider getting an open mortgage if you intend on selling your home soon or expecting cash to pay off a lump sum of your mortgage with minimal penalty,” says Thake. “However, if this is not the case for you, you may want to stick to the closed mortgages, especially if they offer lower interest rates.”

So, unless you’re expecting a large windfall of cash in the near- to mid-future, like an inheritance or a big investment payoff, you’re probably best served by a closed mortgage.

Hopefully, now you’ve got an idea of the pros and cons of the different mortgage types. The mortgage product you choose will come down to your personal situation: are you willing to accept some risk in exchange for a shot at lower rates? Do you need flexible repayment options? Questions like these will help you decide which mortgage is best for you.

Remember: regardless of which type of mortgage you get, your lender will still require you to have an active home insurance policy throughout the entire repayment period (and you should still have one after it’s paid off, too). The mortgage lender would be what’s known as a loss payee on your home insurance policy.

Want to learn more? Visit our Home Buying, Selling and Moving resource centre for everything you need to know about real estate, buying a home, or moving. Or, get an online quote in under 5 minutes and find out how affordable personalized home insurance can be.

About the expert: Rebecca Awram

Rebecca is a member of the Mortgage Brokers Association of British Columbia, which seeks to expand the knowledge and relationships of its members beyond the content of the UBC exam requirements by providing ongoing educational and networking opportunities. Rebecca has over 15 years of experience as a licensed broker.