“We conducted this survey because we’ve been receiving more inquires for home insurance by those living with roommates,” states Daniel Mirkovic, Square One’s President. “We wanted to understand what was driving this trend.”

While there are many reasons why renters choose to have roommates, the top reasons for those surveyed were:

- To help with rent (63%);

- For companionship (25%); and,

- For added security (7%).

According to Statistics Canada, residential property values across the country increased by 11% in 2016. While increased property values build equity for homeowners, they make it even harder for first-time buyers to enter the real estate market. This, in turn, causes more pressure on the already tight rental market. In fact, the average cost to rent a two-bedroom apartment continues to rise every year across Canada.

“With the high cost of rent, it makes sense that most renters have roommates for financial reasons,” states Daniel Mirkovic, Square One’s President. “However, it is surprising how many renters (and their roommates) go without home insurance given the increased risks faced when living with unrelated persons.”

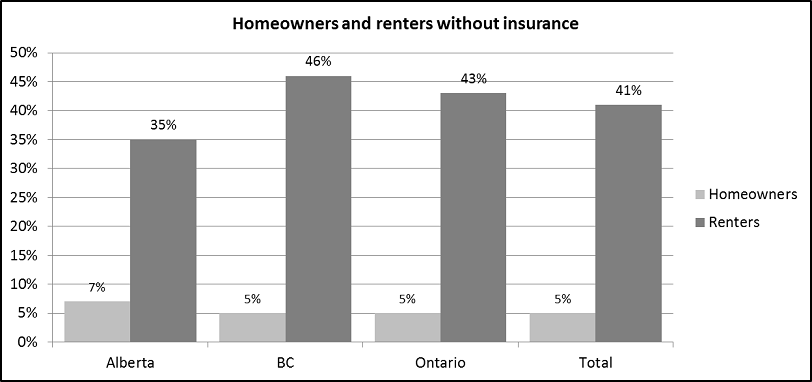

Square One’s survey found that renters are 8 times more likely to go without home insurance than homeowners. As illustrated in the table below, renters in British Columbia are the least likely to have home insurance whereas those in Alberta are the most likely.

Based on Square One’s experience, renters have three common misconceptions about home insurance:

Landlord’s insurance protects renters: Landlord’s insurance specifically excludes the personal property and liability exposures of renters. Accordingly, renters need a home insurance policy to protect their belongings, cover extra expenses if their homes are damaged and can’t be occupied, and pay amounts for unintentionally injuring someone else.

Home insurance is too expensive for renters: Policies can start from as little as $15 a month. And, most insurance providers offer both annual and monthly payment options. To help reduce costs even further, renters can increase the standard policy deductible. A deductible is the amount the renter must pay before the policy will respond.

It’s difficult for renters to get home insurance: Of the three misconceptions, this one has some truth to it. Many renters, especially those living with roommates, may have had difficulty getting home insurance. In recent years, providers, like Square One, are actively offering insurance to renters. So, renters are encouraged to shop around to find a policy that works for them.

For those living with unrelated roommates, you can expect to pay a little more for the added exposure. Most companies charge an extra 10%, which isn’t very much on a $15 a month policy. You can also expect to be assessed a $2,500 deductible for crime-related losses. That means you’ll have to pay the first $2,500 if your belongings are stolen or mysteriously disappear.

When applying for home insurance, you should be prepared to describe how many roommates you have. If you have just one roommate, then you can often be insured under a single policy. If you have multiple roommates, then each of you will need to purchase separate policies. It’s also important to describe your relationship with each roommate. While you may consider a sibling or partner to be your roommate, the insurance provider may classify them as a family member. Most policies automatically cover family members at no extra cost.

Getting the right home insurance, while essential, is just one side of the coin. With a greater pool of roommates to choose from, it’s now more important than ever that you do your due diligence when finding and selecting a roommate. A bad roommate can cause countless headaches and financial stress.

Square One has created an online resource centre for tenants. It offers tips to Canadians on how to find the perfect roommate, structure a lease, and prepare a roommate agreement. To view this resource centre, please visit www.squareone.ca/resource-centres/renter.

One of the articles in this resource centre outlines how to avoid selecting the wrong roommate. As a short summary, here are the top tips to finding the right roommate:

Be upfront about your lifestyle and ask a potential roommate to describe theirs. If you’re an early sleeper, then you might not get along with a night owl. Alternatively, if you wake up early for work, then you probably don’t want a roommate who enjoys partying on weeknights.

Ask potential roommates to complete an in-depth application about their work, income, and references. Keep in mind you cannot ask questions around certain topics, such as religion, sexual preference, or marital status.

After obtaining permission, conduct a background check. If an applicant provides consent, check their credit score, employment history, and rental history. You can also browse their social media profiles on Facebook, Twitter, or LinkedIn.

If you’re a renter living with a roommate, it’s important to stay informed and to have the right insurance coverage in place. To learn more, speak with your insurance provider or call Square One at 1.855.331.6933.

-30-

Established in 2011 and based in Vancouver, British Columbia, Square One offers the only home insurance policy in Canada that can be personalized to your unique needs. That means you only pay for the protection you need. Square One is also one of the few providers to automatically include earthquake, sewer backup and broad water protection in its policies. Square One currently serves British Columbia, Alberta, Saskatchewan, Manitoba and Ontario. For more information about Square One, or to get an online quote, visit www.squareone.ca.

For more information on this release, please contact:

Aneel Mattu

Square One Insurance Services Inc.

Tel: 1.855.331.6933 ext 127

Cel: 1.778.919.2096

aneel.mattu@squareone.ca