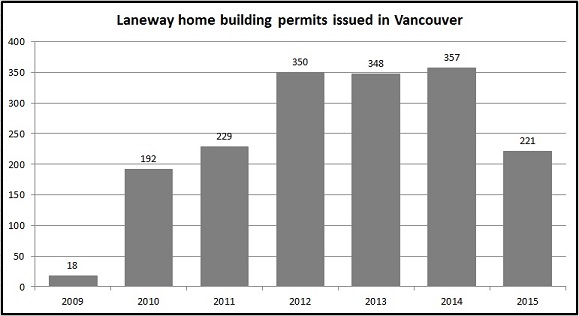

In response to the continued rise in home prices, Vancouver has committed to expand its laneway home program even further. These types of homes offer another source of rental income for homeowners and more rental options for tenants. It’s worth noting that other cities, like Calgary and Toronto, are also looking to develop their own laneway home programs. So, we can expect to see more laneway homes across Canada in the next five to ten years.

“Laneway or carriage homes are increasing in popularity and they’re not cheap to build,” says Daniel Mirkovic, President and CEO at Square One Insurance. “In fact, we insure an 800 square foot laneway home that cost over $350,000 to build. Obviously, having the insurance protection for an asset of that value is important.”

Typically, a homeowner must insure their laneway home as a detached structure under their main residence’s policy. The homeowner must decide what limit of insurance is required for the laneway home. And, the insurance provider usually covers the cost to replace or rebuild the home up to the limit of insurance selected by the homeowner.

For homeowners insuring their laneway home as a detached structure, it’s important that they consider three additional, often unexpected, factors when selecting their limit of insurance:

Debris removal: In the event a laneway home is destroyed, expenses associated with properly removing debris can be significant.

Post-event inflation: If a natural disaster occurs and affects many homes, rebuild costs will increase due to increased demand (and limited supply) after the disaster.

Building bylaw changes: Policies do not typically cover costs associated with building code changes. For example, the home may need to be made wheelchair accessible if rebuilt.

“Determining the appropriate rebuild cost and limit of insurance can be very difficult for homeowners. That’s why some insurance providers, like Square One, now allow clients to insure laneway homes under a completely separate policy,” says Daniel.

By insuring a laneway home under a separate policy, the homeowner has two major benefits:

Guaranteed building replacement cost coverage: Assuming policy conditions are met, the full cost to rebuild the home will be covered even if that cost exceeds the coverage limit.

Protection for claims free discounts: Submitting a claim on your laneway home will not impact the claims free discounts included on the insurance for your main residence.

A homeowner should be aware that there are a couple trade-offs if they opt to insure their laneway home under a separate policy. First, they may pay a slightly higher premium when compared to the cost of insuring the laneway home as a detached structure. Second, if a loss occurs that affects both the laneway home and the main residence, two separate policy deductibles will apply.

All residents with laneway homes should take steps to understand the insurance options available to them. To learn more, speak with your insurance provider or call Square One at 1.855.331.6933. And for more home insurance tips, visit www.squareone.ca.

-30-

Established in 2011 and based in Vancouver, British Columbia, Square One offers the only home insurance policy in Canada that can be personalized to your unique needs. That means you only pay for the protection you need. Square One is also one of the few providers to automatically include earthquake, water backup and broad water protection in its policies. Square One currently serves British Columbia, Alberta, Saskatchewan, Manitoba and Ontario. For more information about Square One, or to get an online quote, visit www.squareone.ca. For more information on this release, please contact:Aneel Mattu

Square One Insurance Services Inc.

Tel: 1.855.331.6933 ext 127

Cel: 1.778.919.2096

aneel.mattu@squareone.ca